Unleash the potential of your investment ideas

Strategy-building made intuitive and effective. Our platform bridges the gap between sophisticated portfolio management and user-friendly experience, providing a single space to experiment, learn, and refine.

Craft, test, and refine your strategy

From backtesting to data-driven insights, we bring you the knowledge and precision needed to make smarter investment decisions.

Blueprint your strategies

Start by designing individual models. Each model is a custom investment strategy with specific rules to select assets, defined risk parameters and allocation methods.

Create your portfolio

Combine multiple models to form a comprehensive portfolio. Define rules to allocate capital to each model according to your strategy and risk tolerance.

Run simulations backtest

Conduct simulations to backtest your portfolio. See how your combined models would have performed using historical data.

Analyze and finetune

Analyze the results of your test and simulations to identify strengths and weaknesses. Adjust your models and portfolio as needed for optimal performance.

Build Portfolios. Backtest with Confidence.

Design multi-model portfolios, define allocation rules, and simulate real-world performance over time. Fincanva’s backtesting engine lets you see how your strategy would have handled past markets—before putting your capital at risk.

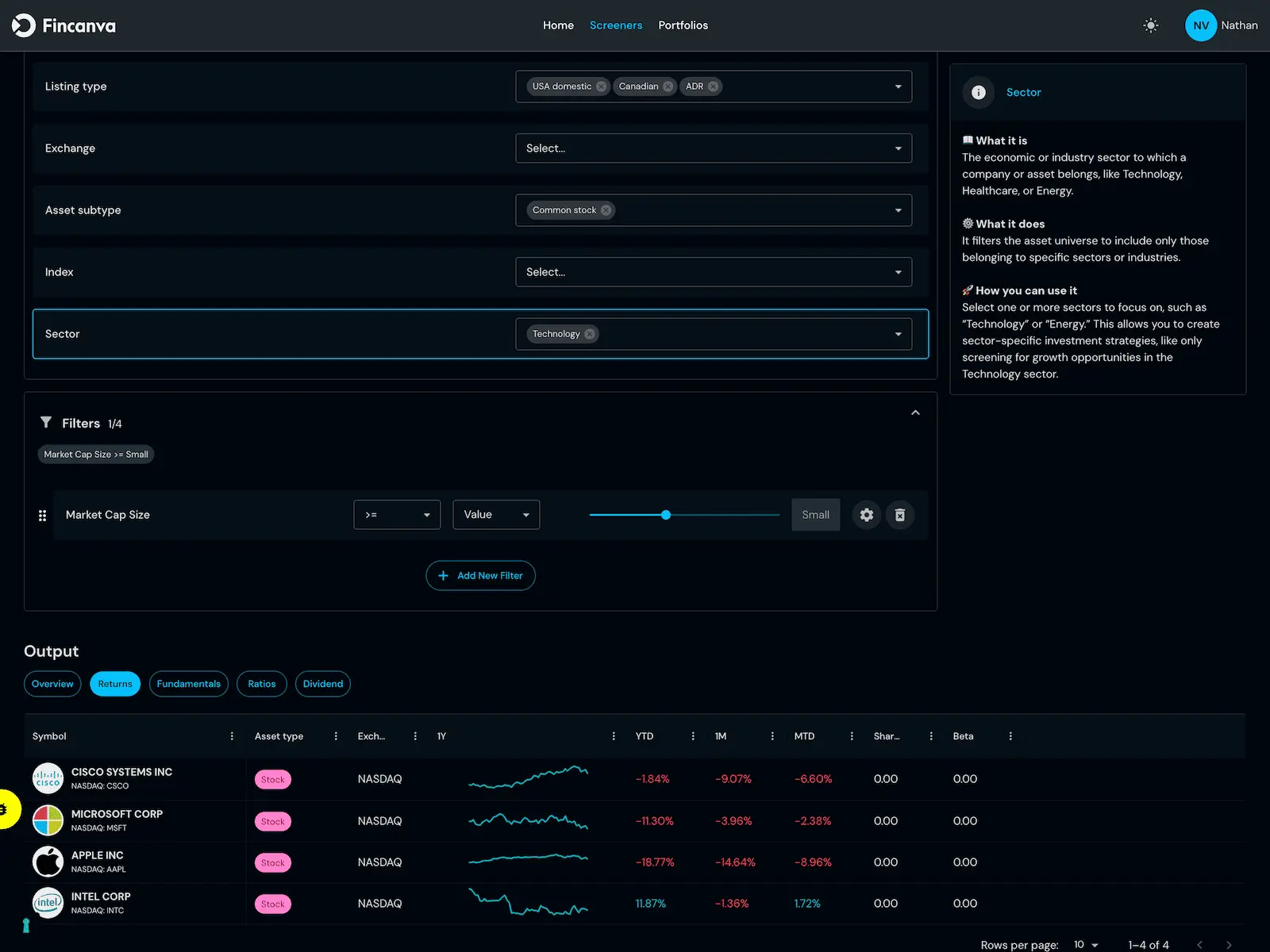

Powerful Filters. Realistic Simulations.

Fincanva’s customizable screener engine lets you define precise criteria to identify matching assets. Once filtered, simulate their historical performance within your strategy to see how they behave under market conditions—before making any real decisions.